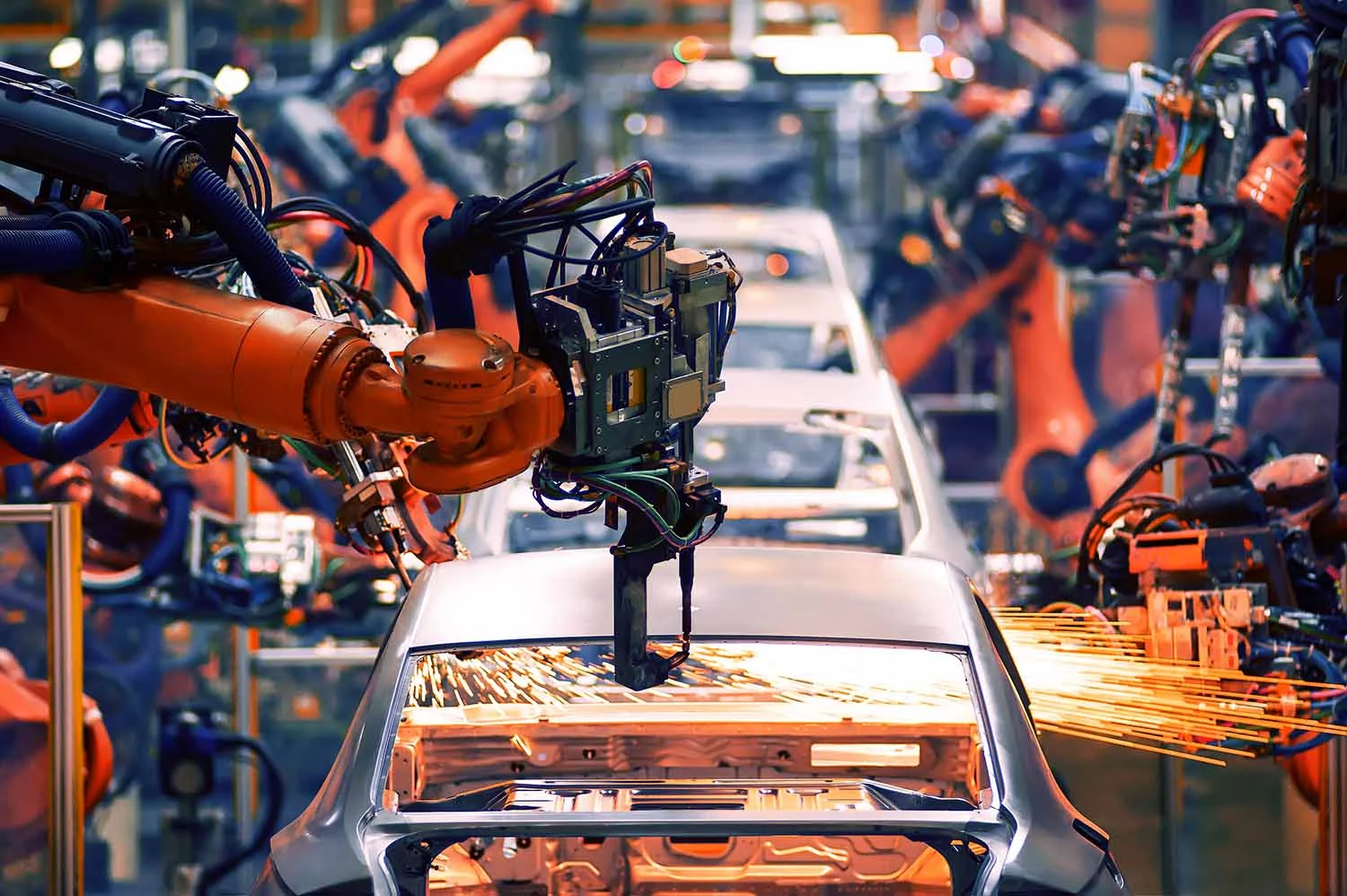

The global impact and production of metal manufacturing commodities including automotive, medical, pump, toy, and sporting goods industries.

If you’re in the manufacturing industry, you’re fully aware of the many supply chain uncertainties over the last 18 months.

We know that the pandemic is not over yet—we’re still feeling its impact—with product shortages and price increases. But we’re all working together toward a new normal.

As a professional, you understand the need to stay abreast of the state of the manufacturing industry—import/export trends by country, new manufacturing methods, and opportunities to utilize new materials.

“Wherever there is change, and wherever there is uncertainty, there is opportunity!”— Mark Cuban.

Below is an analysis of trade statistics from the U.S. Customs database* records of Inbound Ocean Cargo from 2021 and 2020 compiled and analyzed by our team.

You may notice some unexpected and intriguing trends that may be of value to your business.

A picture is worth 1000 words. please check out the charts we’ve provided in an easy-to-understand graphical representation of these trends.

Let’s compare the first half of 2021 to the same period a year ago. Please take a look at the graphs below as we analyze the data in several ways:

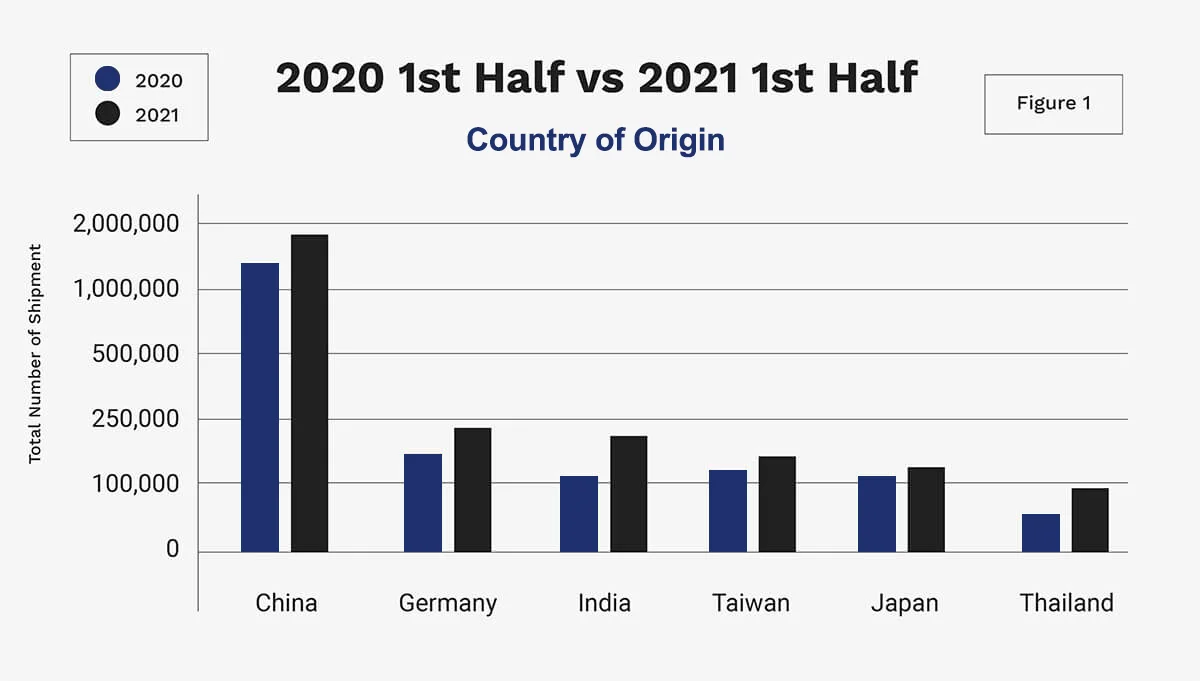

Figure 1 indicates that imports are on the rise from all countries for 2021H1 vs. 2020H1. China, the leader in this category, saw a 34% increase in the total number of shipments. At the same time, the prize for the most significant increase goes to India with 85%.

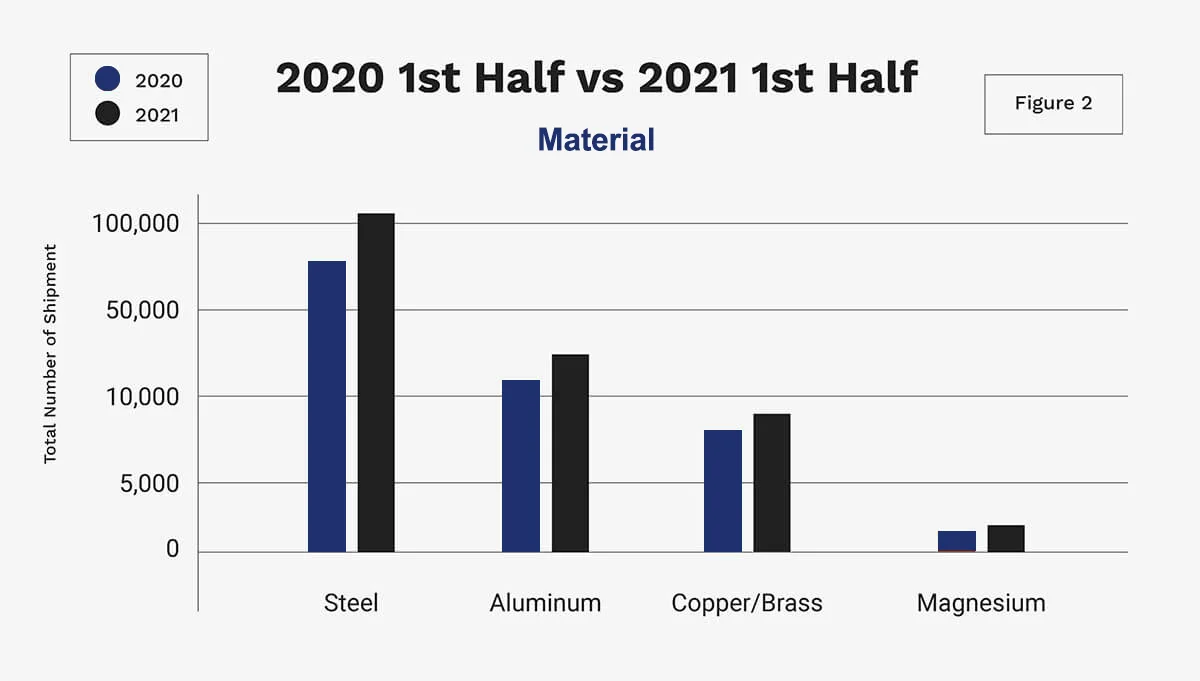

Figure 2 shows that imports are increasing for all materials displayed. The most significant material, steel, showed a 37% increase. Aluminum had a 56% increase in the total number of shipments, the highest percentage overall.

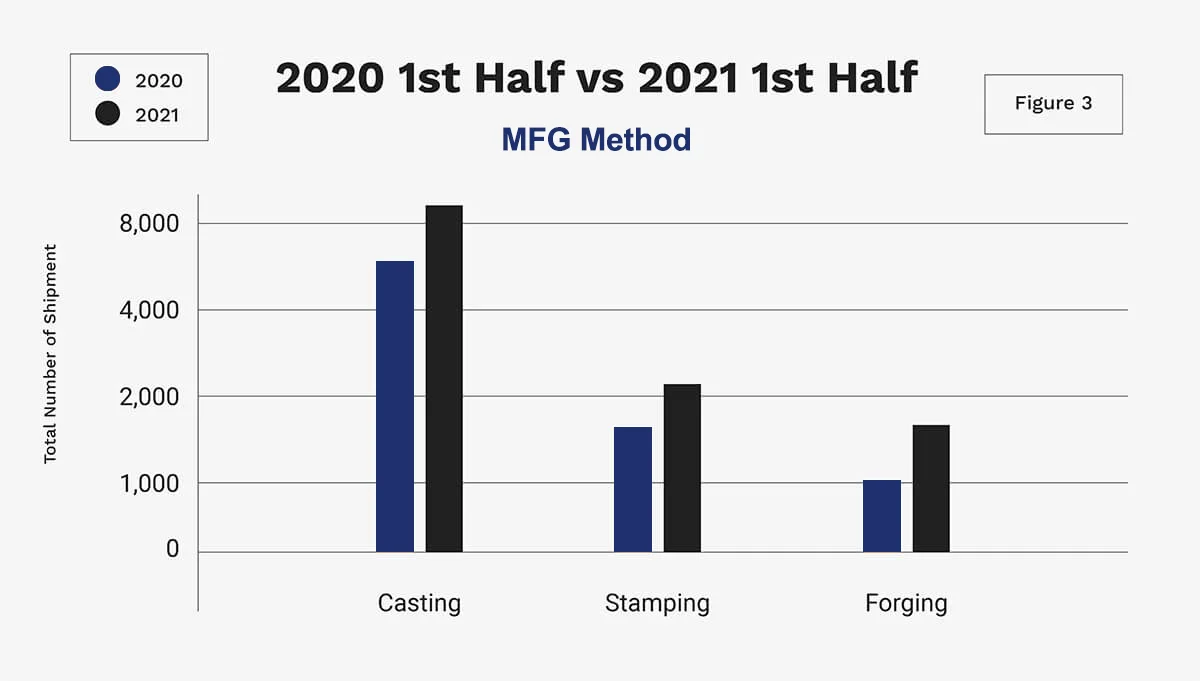

Shipments increased for all materials tracked in Figure 3 for the first half of 2021 as compared to the same period year ago.

Castings, the leader in this category, increased 37%, with Stampings at 29%, and Forgings at 62%.

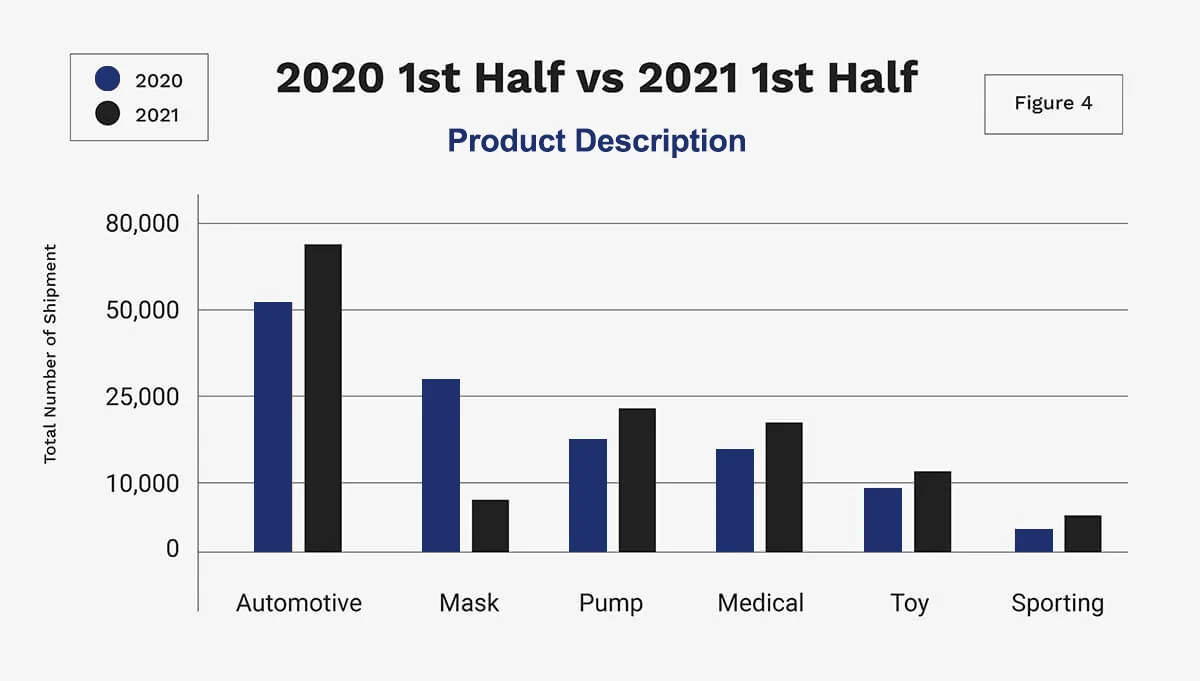

Figure 4 indicates an increase in all categories shown here — except for masks. Automotive, the overall leader, delivered a whopping 52% increase in 2021H1 as compared to 2020H1. The most significant increase belongs to sporting (cloth, equipment) with 63%. At least for now, we see a substantial decline in the demand for masks with -73% (stay tuned as the pandemic saga continues).

The pandemic has been an unfortunate reality for many of America’s factories. The good news? The demand for goods and services supported by global trade are on the rise. People are driving more, playing more, and improving their homes.

Innovation is the key to success in manufacturing. Smart manufacturers are exploring opportunities for using castings, stampings, and forgings that will save them money over time while beating their competition to market also!

Steel, Aluminum, Copper/Brass, and Magnesium are all on the increase, per Figure 1. These materials are essential to supporting machinery, including computers, industrial machinery & equipment, and vehicles. Steel—the dominant material on the list—had a 37% increase in the total number of shipments. Aluminum, Copper/Brass, and Magnesium also had increases of 56%, 16%, & 20%, respectively.

“World merchandise trade volume is expected to increase by 8.0% in 2021 after falling 5.3% in 2020, a smaller decline than previously estimated.”

So, what does this mean to you? Global trade is increasing, but it’s wise to keep a close watch on the trends.

Significant players in global trade—automotive, pump, and medical—showed increases of 52%, 35%, & 41%, respectively (ref. Figure 4). As many individuals curtailed travel and instituted work from home and homeschooling, the demand for toys and sporting goods increased accordingly at 14% & 63%, respectively.

The only item we tracked that showed a decrease in international trade volume was Masks, with a 73% drop from 2020H1 to 2021H1. However, the second surge of the pandemic could change this picture rapidly.

The pandemic has been felt for almost two years, and all industries are still feeling its effects. The manufacturing workforce is tenacious, adaptable, and resilient. While the epidemic’s consequences may linger for years to come, global trade appears to be recovering, albeit at a slower rate of development.

The number of government stay-at-home orders is falling. Many individuals are returning to the workplace. A desire to travel has been pent up—to visit friends and relatives we haven’t seen since the pandemic started. Imports in the automobile sector have dramatically increased as a result of this development.

Automotive imports are on the rise. “The National Automobile Dealers Association (NADA) predicts that new light-vehicle sales will hit 16.3 million units for the year according to first-quarter sales in 2021, estimating an increase of 12.7% compared to 2020.”

The pandemic had a broad impact on imports of goods made by casting, forging & stamping. But, the current trade statistics (see Figure 3) show a significant rebound over a year ago.

“Metal prices continued to climb in early 2021, driven by strong demand in China, the ongoing global economic recovery, and supply disruptions. Metal prices are projected to average 30% higher in 2021 than last year before easing in 2022.”

“Strengthening global demand. Global metals demand has picked up since the second half of 2020, particularly in China, the world’s largest metal consumer. Chinese metals demand has been boosted by investment in infrastructure and construction, augmented by strong global uptake in autos, appliances, and machinery. The global manufacturing PMI (Purchasing Managers’ Index) rose to 55.8 in April, the highest level in 11 years.”

Tariffs are only so effective on imports. It is still cheaper to import them from another country than manufacture them in the United States for most goods.

Between 2018 and 2020, U.S. tariffs on China increased by more than a factor of six, yet the two economies remained linked.

India experienced an impressive 85% increase in exports, with 208k shipments for the first half of 2021. It’s quickly closing in on the number two position held by Germany with 231k shipments and a more modest 32% increase.

Outsourcing manufacturing to other countries will be a vital strategy for businesses looking to stay ahead of the competition. Free trade and imports will enable firms to benefit from lower manufacturing costs while still maintaining high standards. As a result, organizations must collaborate with competent supply chain experts with years of expertise and a track record of delivering proven results.

Contributed by @Aradhya Malhotra (May 2022)